Finbots

Faster lending with credit modeling.

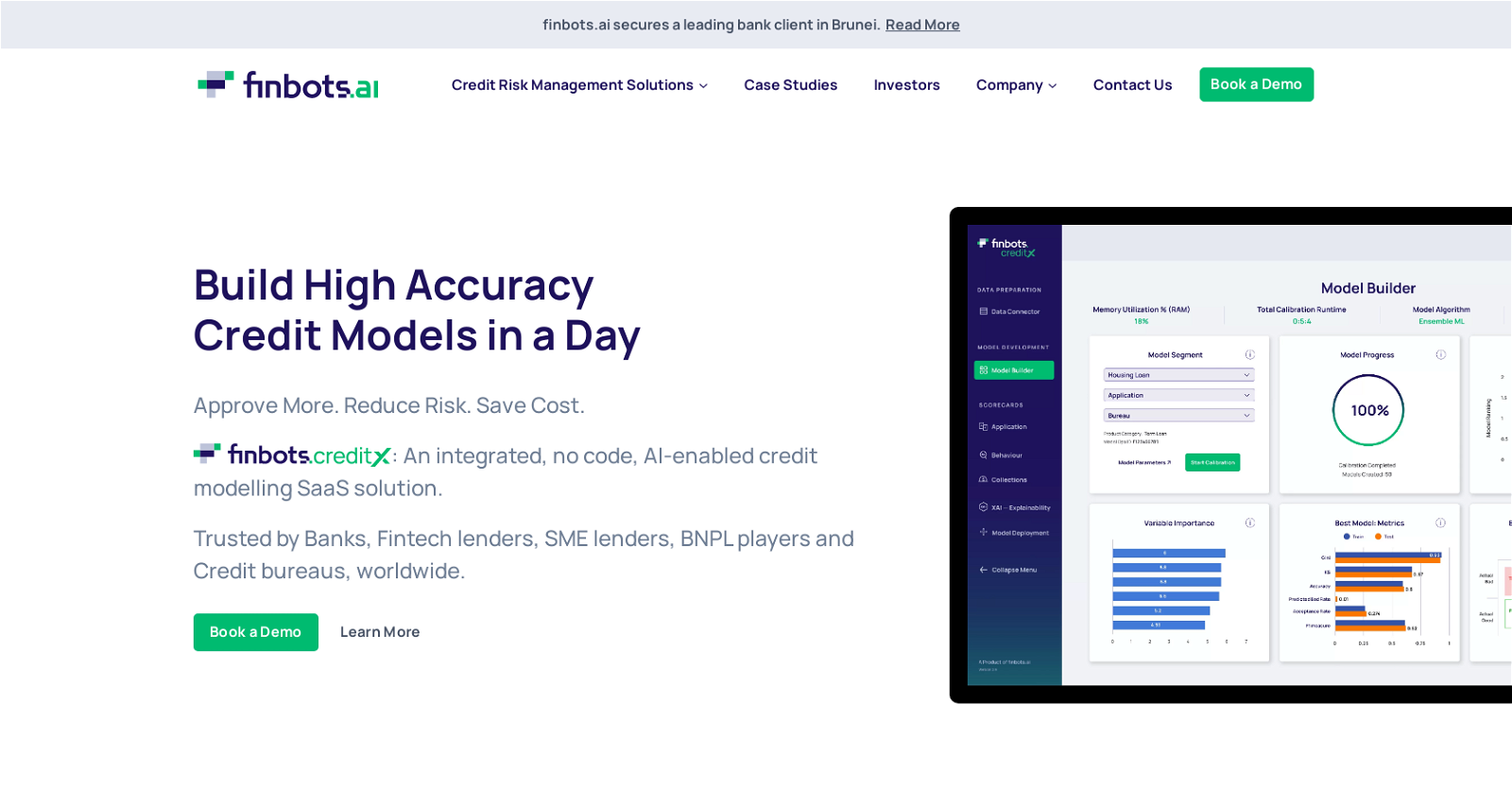

Finbots.ai is an AI-powered credit modelling solution that helps lenders to build, validate, and deploy high-accuracy credit models quickly within minutes. The tool offers three types of scorecards for credit risk management – application, behavior, and collection scorecards – which are designed to minimize risk and maximize collections. It operates on five core principles of accuracy, speed, transparency, adaptability, and inclusiveness while providing full control over the decisions made. Finbots.ai has been trusted by banks, fintech lenders, SME lenders, BNPL players, and credit bureaus worldwide with significant results including an increase in approvals up to 25%, a decrease in loss rates of 15%, and a 20-points increase in GINI.

Overall this tool provides a cost-effective and innovative solution for credit risk management. It allows lenders to approve more loans with less risk while also being transparent and fair with customers. Finbots.ai's ability to be integrated with existing data systems and workflows means it can save time compared to manual processes as well as provide more inclusive lending practices through its accurate predictions of creditworthiness. By utilizing AI algorithms into the platform it creates greater efficiency for credit decisioning across the full lifecycle of applications, behavior analysis and collections management resulting in improved customer experiences overall.

Would you recommend Finbots?

Help other people by letting them know if this AI was useful.

Authentication required

You must log in to post a comment.

Log in